The Finance Department has decided to sanction one term DA to all govt employees, teachers and pensioners. It will be disbursed in June as cash. Now the arrear is for the two terms and it is 11 month arrear for 1% DA and 6 month arrear for 2% DA. From this, 11 months arrear will be given along with salary for the month of July.

How to process DA arrear sanctioned to us as per G.O (P) No.84/2018 Fin date 07/06/2018 is given here in detail.

Since the DA arrear is disbursed as cash amount, it should be included in the salary for the month of June. After that Salary should be processed.

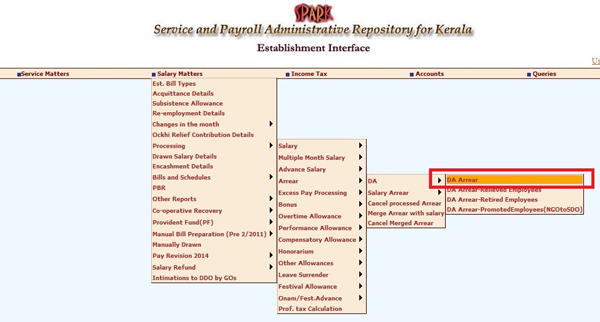

Step 1:

Select Salary Matters - Processing - Arrear- DA- D.A Arrear

Step 2:

Salary matters -> Processing -> Arrear -> DA -> Select DA Arrear, DDO code, Bill Type, Order number (84/2018) etc. To process DA arrear bill click ‘Select employee’ and mark tick in the check box against the employees and submit it.

Step 3:

After processing, DA Arrear bill can be generated thus- Salary Matters -> Bills and Schedules -> Arrear -> DA Arrear -> DA Arrear Bill. Check it and confirm it before printing inner bill.

Step 4:

Then give Salary Matters -> Arrear -> Merge arrear with salary. For this DDO code, processed month in Arrear , Processed year be given. Give the month of salary with which arrear is to be merged in ‘Arrear to be merged with the salary for the year’. Then select the button - Payment along with the Salary bill. Click tick mark in the right side of the box while selecting ‘Processed Year’ and click ‘Proceed’ after this.

Step 5:

Once the merging process is over, you will get a message regarding this. Then click Salary matters -> change in the month -> Present Salary. Confirm whether the amount is added.

Step 6:

Then the usual procedure for salary processing can be done by selecting Salary Matters ->Salary -> Monthly Salary Processing

Post A Comment:

0 comments: